Find Your Perfect Self-Employment Path

Not all self-employment fields are created equal. Review the table below to see which suits you best:

| Field | Personality Fit | Required Skills | Experience Needed | Average Pay | Competition Level | Startup Costs | Work-Life Balance | Growth Potential |

|---|---|---|---|---|---|---|---|---|

| Freelance Writing | Introverted, detail-oriented, independent | Writing, research, SEO knowledge | Portfolio of samples | $25-85/hr | High | Very low ($0-200) | Good | Moderate |

| Graphic Design | Creative, visual thinker, patient | Design software skills, visual communication | Portfolio required | $25-75/hr | Very high | Moderate ($500-2,000) | Good | High |

| Web Development | Analytical, problem-solver, tech-savvy | Coding languages, UX/UI principles | Sample projects or portfolio | $40-150/hr | High | Low ($200-1,500) | Good | Very high |

| Social Media Management | Extroverted, trend-aware, organized | Content creation, platform knowledge, analytics | Personal success or small portfolio | $20-65/hr | High | Very low ($0-200) | Moderate | High |

| Virtual Assistant | Detail-oriented, organized, responsive | Administrative skills, tech-savvy, multitasking | Basic office experience | $15-45/hr | Moderate | Very low ($0-100) | Good | Moderate |

| Online Coaching/Consulting | Extroverted, empathetic, confident | Industry expertise, communication, sales | Substantial industry experience | $75-200/hr | High | Low ($200-1,000) | Good | High |

| E-commerce / Dropshipping | Risk-taker, analytical, persistent | Marketing, basic design, customer service | No formal experience needed | Variable | Very high | Moderate ($500-5,000) | Challenging | High |

| Digital Marketing | Data-driven, creative, strategic | Analytics, SEO, content creation, paid ads | Track record or certifications | $40-150/hr | High | Low ($200-1,000) | Moderate | Very high |

| Photography/Videography | Creative, patient, detail-oriented | Technical camera skills, editing software | Portfolio required | $40-200/hr | Very high | High ($1,000-5,000+) | Challenging | Moderate |

| Skilled Trades | Hands-on, practical, independent | Technical skills, safety protocols | Apprenticeship or certification | $40-90/hr | Moderate | High ($1,000-10,000+) | Good | High |

Why Self-Employment?

Self-employment is a lifestyle decision that’s gaining serious momentum.

What’s driving this movement? Freedom to set your own hours, control over your income ceiling, and the ability to choose who you work with top the list.

A 2021 FreshBooks survey revealed that 40% of traditionally employed Americans were considering making the jump to self-employment, with nearly half saying pursuing self-employment was their number one goal in life.

Source: Freshbooks

But here’s the part most guides miss: successful self-employment doesn’t start with business cards, formal structures, or perfect websites. It starts with getting paying clients—fast.

–

Beyond the Buzzwords

Self-employment simply means you work for yourself rather than an employer. You find your own clients, set your rates, and handle your own taxes.

In the United States, about 10% of the total workforce (16.75 million workers) were self-employed as of March 2024. Men (13%) are more likely to be self-employed than women (10%)

Source: U.S Bureau of Labor Statistics, Public Policy Institute of California

Self-employment options range from freelancing (selling services) to creating products to consulting or contracting.

A key difference from traditional employment is that you’re responsible for generating your own income stream—no guaranteed paycheck waits every two weeks. This independence is especially appealing to younger generations, with a GoDaddy survey finding that 32% of Gen-Z individuals (ages 18-26) were already business owners or side hustlers, while another 21% planned to start within the next year.

Source: GoDaddy

–

Is Self-Employment for You?

Not everyone thrives in self-employment. And that’s okay.

Those who succeed typically handle uncertainty well, stay self-motivated without a boss, and can wear multiple hats (marketer, service provider, accountant).

Your support network matters too. Having people who understand your journey can make the difference between giving up too soon and pushing through tough periods. Joining industry-specific communities where you can connect with others facing similar challenges can help too.

–

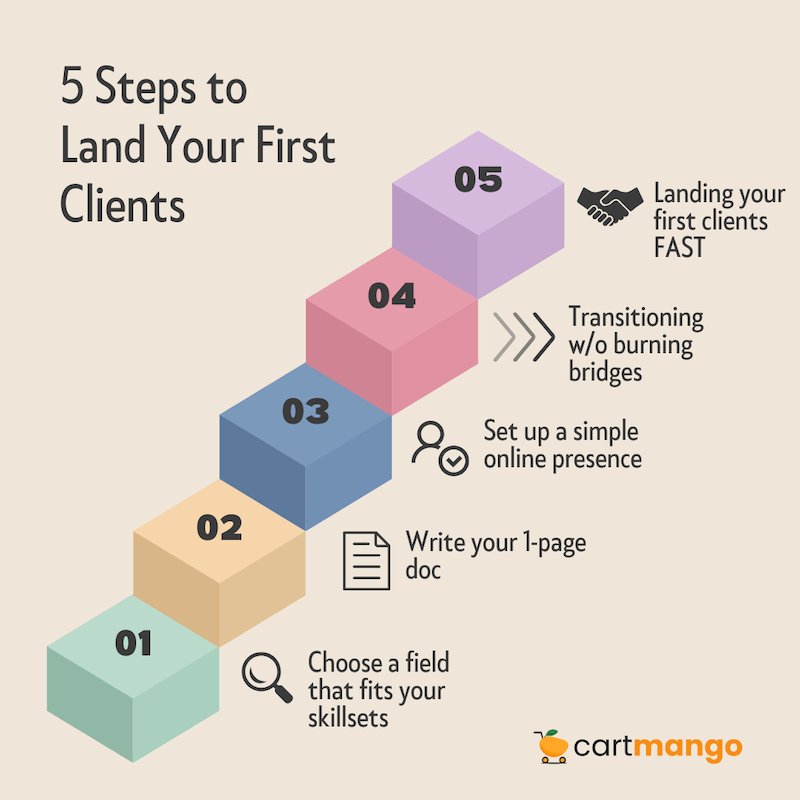

Step 1: Choose a Field That Fits Your Skillsets

Look at your existing skills first. What do people already ask for your help with? What problems can you solve? The comparison table above can help you identify which field aligns with your personality and skills.

Market opportunity matters as much as passion.

Study potential competitors on platforms like Upwork or Fiverr to understand pricing and positioning. Set specific goals with deadlines, not vague wishes like “I want to be self-employed.”

–

Step 2: Write Your 1-Page Doc

Forget 40-page business plans.

Create a one-page document answering:

What service/product do you offer?

Who needs it most?

How much will you charge?

How will people find you?

Get specific about your target clients. “Small business owners” is too broad; “local restaurants struggling with social media” is better.

For pricing, research what others charge but don’t automatically go low—people often associate low prices with low quality.

–

Step 3: Set Up A Simple Online Presence (no website needed)

You don’t need a perfect website to start. A simple LinkedIn profile update announcing your services can work.

Danny Margulies shares that he started his freelance copywriting business with just a basic Upwork profile and made over $100,000 in his second year. He recommends using online freelance marketplaces like Upwork to find paying work, stating that “100% of his freelance work is done on Upwork”.

Create a portfolio with 3-5 samples, even if they’re projects you did for yourself or mock examples.

Join Facebook groups and Slack communities where potential clients hang out

Be helpful before pitching services.

As Margulies explains, “If you can write an email, or a simple blog post, or even a one-paragraph product description, these are some of the many different types of jobs that clients pay good money for every day”. The key is getting started rather than waiting for perfection.

–

Step 4: Transitioning Without Burning Bridges

Starting as a side hustle while employed reduces risk.

The transition period is critical—use it to build both skills and savings. Track your side income and expenses separately from your regular job to get a realistic picture of your financial situation.

When leaving a job, give proper notice and maintain good relationships—former employers often become first clients or referral sources.

The psychological shift is just as important as the financial one. Set work hours and boundaries to avoid both burnout and procrastination.

–

Step 5: Landing Your First Clients FAST

The fastest client acquisition method is often telling everyone you know about your new service.

Your existing network already knows and trusts you, making them more likely to hire you or refer you to others.

Cold outreach works when personalized.

Send custom emails daily to potential clients with specific suggestions for their business, not generic copy-paste messages.

Track your response rate and adjust your approach based on feedback.

Online platforms like Upwork and Fiverr offer immediate access to clients.

The best way to start freelancing is to know what kind of jobs to search for, where to find them, and how to land them. Start with beginner-friendly jobs — there are tons out there that need skills you probably already have.

–

When (and Only When) to Formalize Your Business

The right time to formalize comes when you’re consistently earning income.

For most, this means waiting until you’ve had paying clients for 6+ months.

Basic formalization might include getting an EIN (free from the IRS) and opening a separate checking account. Skip expensive legal structures until you’re making at least $3,000 monthly consistently.

Self-Employment Taxes Made Simple

As a self-employed individual, you’re responsible for handling your own taxes.

When you work for yourself, you pay a special tax called self-employment tax. This covers your Medicare taxes and Social Security. Regular employees only pay half of this tax because their employers pays the other half. But since you’re your own boss, you have to pay both parts yourself.

When you own business ventures, you’ll need to file quarterly estimated taxes rather than waiting for annual income taxes. This helps avoid penalties from the IRS. Your profit (earnings minus business expenses) is what gets taxed, and you’ll use Schedule C to report this income.

Many small business owners don’t realize they can deduct business expenses like phone bills, internet costs, and even part of their rent if they use space in their home as an office space. These deductions can significantly reduce your tax burden.

If you’re unsure about the process, don’t worry. The common forms and filing requirements seem complex at first, but there are plenty of resources available to help you track everything properly.

Choosing the Right Business Structure for Your Journey

When starting your self employment journey, one key decision involves choosing between business structures like sole proprietorship, LLC, or corporation.

Each offers different benefits and levels of personal liability protection.

A sole proprietor has complete control but also full responsibility for the business. This form is the simplest to start and requires minimal paperwork to file, but it offers no personal liability protection from business debts.

An LLC protects your personal assets while still keeping things relatively simple. Many self employed individuals choose this option once they start seeing consistent profit. Though it requires more investment of time and money to form, the benefits often outweigh the costs in the early stages.

Small business owners should also consider opening a business bank account regardless of their structure. This makes it easier to track business expenses separately from personal finances.

–

Building Your Client Base and Managing Operations

The heart of self employment is finding and serving customers or clients. Your skills are what you sell, so focus on identifying who needs what you offer.

In the early stages, many successful entrepreneurs rely on friends and partners for referrals. Word-of-mouth remains one of the most powerful ways to find new clients, even in today’s digital world.

Managing employees may come later, but initially, most of the responsibility falls on you. You’ll need to handle money wisely, allocating funds for taxes, expenses, and personal income.

Funding your business might involve personal savings, loans, or outside investment. Be strategic about major expenses like rent or office space until your income stabilizes.

Remember that the real measure of success isn’t just generating money—it’s creating profit after covering all your expenses. Stay focused on operating efficiently, especially in those crucial early stages.

Self-Employment Challenges

Income fluctuation is normal

Plan your finances around your lowest-earning months, not your best ones. During slow periods, use the time for skill improvement or creating content that attracts clients.

Set clear work hours and physical boundaries

Working from home doesn’t mean always being available. The isolation challenge is real, particularly for those in fields that don’t require much collaboration. Consider co-working spaces or regular networking events to maintain social connections.

Dare to say no.

Learn to say no to projects that pay poorly or clients who show red flags early. Developing clear policies around payment terms, revision limits, and communication expectations will save you countless headaches later.

–

Real People, Real Results

Sagan Morrow: From Charity Worker to Full-Time Freelancer

Sagan Morrow wasn’t happy at her charity job.

She felt her work wasn’t appreciated. Instead of just quitting, she spent five months getting ready to be her own boss. She made plans for her business and marketing, and talked to people she had worked with before.

In April 2014, she officially started working for herself full-time. She tried different types of work to see what she liked best. She found several clients who needed help with social media for the long term, which gave her steady income. Her blog helped her find new clients too.

Sagan says taking courses to improve her skills, like Elite Blog Academy, really helped her business grow. What’s important about Sagan’s story is that she didn’t just jump in without thinking. She carefully planned her move to self-employment and has been successful for years.

Source: Sagan Morrow’s blog

–

Ed Gandia: From Sales Job to Writing and Teaching

Ed Gandia was the main earner for his family when he had a good-paying sales job.

He started writing for clients on the side in 2004 while keeping his regular job. By mid-2006, his side work was making enough money that he could leave his day job.

In 2010, Ed wrote a book called “The Wealthy Freelancer” with two other writers. This helped him become known as someone who could teach others about freelancing. He started The International Freelancers Academy to help other freelancers succeed and hosts a podcast called High-Income Business Writing.

What’s interesting about Ed’s story is how his work changed over time:

He started by writing for clients.

Then moved into teaching others how to be better freelancers.

His business evolved based on what worked and what he enjoyed.

Source: B2B Launcher

–

Emma Clark Gratton: Building a Business with Her Husband

Emma and her husband ran GRATTON, a furniture and custom woodworking studio in Melbourne, for about four years.

They started small with just her husband working, but grew to have staff, waiting lists for their products, and new product lines.

What makes Emma’s story different is that she worked with her spouse. Despite successfully fixing up houses together and raising kids, running a business together was much harder. Emma handled talking with clients, marketing, and running the business while her husband managed the building and workshop.

The business did well and grew bigger, but eventually, Emma decided to take a job at ArtsHub to help save their marriage. Her story shows that success doesn’t always mean staying self-employed forever—sometimes it means knowing when it’s time for a change.

Source: LinkedIn

Important note:

These real-life examples show that self-employment looks different for everyone.

Some people stick with it for decades, while others use it as a stepping stone to something else.

What matters is that each person found a path that worked for them and their goals.

–

Your Self-Employment Action Plan: Next Steps

Week 1: Decide on your field based on the comparison table above and create 3-5 portfolio samples.

Week 2: Tell 25 people about your new service and set up a basic online presence.

Week 3: Join 3 online communities where potential clients gather and begin contributing helpfully.

Week 4: Send 10 personalized outreach messages daily to potential clients.

Track two key metrics:

Number of client conversations

Proposal amount submitted

These leading indicators predict future income better than current earnings.

Self-employment isn’t about escaping work—it’s about choosing work that matters to you and building on your own terms. The path won’t be straight (in fact it will be hard)… but with focus on getting clients first and ignoring the rest until later, you’ll skip the pitfalls that trap most beginners.

Your first year of self-employment is about survival and learning, not perfection.

Start now. Adjust as you go. Build the independence you’re seeking one client at a time.

Related

- Gumroad vs SureCart: the “catch” (2026)

- Payhip vs SureCart: the hidden catch nobody talks about (2026)

- Sellfy vs SureCart: your recurring payments at risk (2026)

- SendOwl vs SureCart: recurring revenue you don’t own (2026)

- SamCart vs SureCart: the recurring payment problem (2026)

- ThriveCart vs SureCart: who really owns your customers? (2026)

- Sellfy vs Easy Digital Downloads: the revenue hostage (2026)

- SendOwl vs Easy Digital Downloads: the revenue prison (2026)

- SamCart vs Easy Digital Downloads: the revenue trap (2026)

- Easy Digital Downloads vs Payhip: the revenue ransom (2026 )